Lloyds Banking Group, one of the largest UK banking groups are to offer its customers of Halifax, Bank of Scotland and Lloyds, gambling blocking software to give maximum protection from gambling related harm.

Block Gambling Website Transactions

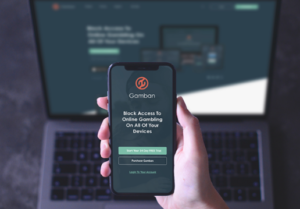

The new Gamban gambling blocking software will be available to customers via their mobile banking app for three months, free of charge. Customers can now block all transactions to gambling websites if they fear their gambling habits are becoming out of control.Lloyds are among other banking groups who offer their customers a way of blocking transactions to gambling websites via their mobile apps and continue to protect their customers from gambling related harm. Banking groups are joining regulatory bodies and campaigners in a bid to reduce gambling harm, the more layers of protection offered to vulnerable people, the more chance people will take advantage of the services and stop a potential gambling habit before it becomes out of control.

Multi-Layered System

Not only do Gamban offer the blocking system for regulated gambling sites, they offer a constantly growing list of unregulated, illegal and offshore websites. The more barriers in place the more effective the system will be. Having just one barrier could see vulnerable people seek other ways of funding their gambling habits, Gamban have a multi-layered system which is much more effective in the prevention of gambling harm.Elyn Corfield, Managing Director of Consumer Finance at Lloyds said, “ We know that gambling related harm can be serious and have long term impacts on our customers and we are committed to making sure they can easily access a range of support. In addition to our card controls that allow the freezing of gambling transactions we are delighted to have developed a pilot Gamban offering our customers three months free access to their software, providing another level of protection.”